Median Net Worth By Age: How Your Finances Compare Today

Do you ever think about your money situation and wonder how you stack up against other people your age? It's a common thought, you know, to look around and feel like everyone else has things figured out, or maybe you're doing better than you think. This feeling of wondering if you are ahead or behind financially is a pretty normal part of life for many, it seems.

Many people ask themselves, "How does my net worth compare to others in my age group?" or "Am I building wealth effectively?" It's a natural thing to consider, and honestly, understanding where you stand can give you a clearer picture of your own financial health. We often hear about averages, but the median net worth offers a different, perhaps more accurate, way to look at things, especially when it comes to personal finances, you see.

This article will help you understand what median net worth means, why it matters, and how your own financial standing might compare to others in different age groups. We will also share some ideas to help you improve your financial situation, because, well, that's what many of us want to do, right?

Table of Contents

- What is Median Net Worth?

- Median Versus Average: Why It Matters

- Calculating Your Own Net Worth

- Median Net Worth by Age Group: Current Numbers

- Key Factors That Influence Net Worth

- Steps to Build Your Net Worth

- Frequently Asked Questions About Net Worth

What is Median Net Worth?

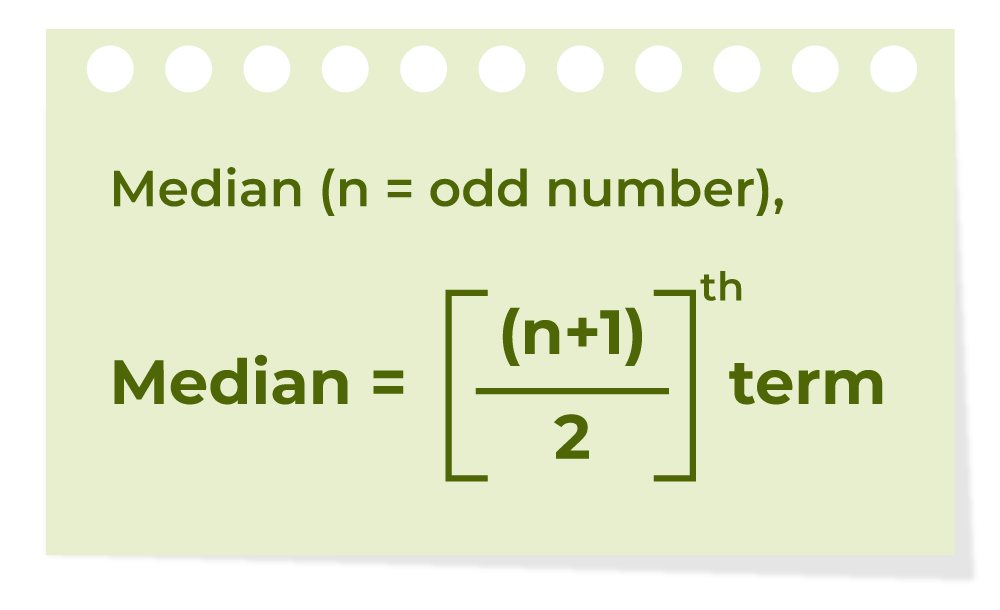

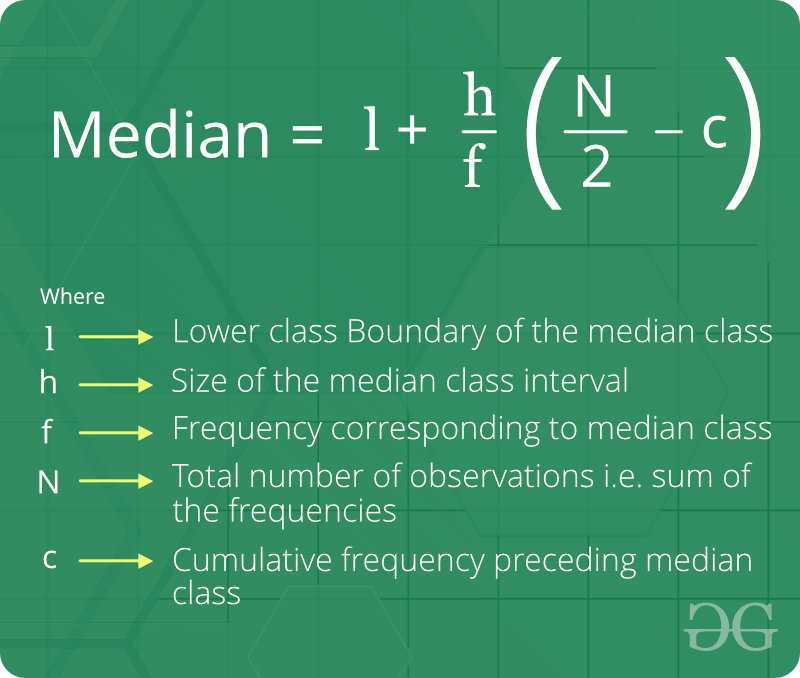

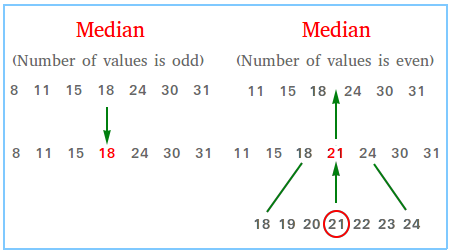

The median of a set of numbers is the value that sits right in the middle. Imagine you have a list of everyone's net worth, sorted from the lowest to the highest. The median is the net worth of the person exactly in the middle of that list. It separates the lower half of the group from the higher half, basically, so it's a very central point.

For a group of financial numbers, like net worth figures, the median is the middle value. If you line up all the numbers in order, from smallest to largest, the median is the one right in the center. If there are two middle numbers, which happens with an even number of values, you simply add those two middle numbers together and then divide by two to find the median, you know. It's a straightforward way to find the middle ground.

This measure is especially helpful because it does not get pulled too much by extreme values. For example, if a few people in a group have a really, really high net worth, the median still gives you a good sense of what the typical person in that group has, unlike an average, which can get skewed, actually. It provides a better picture of what's common.

Median Versus Average: Why It Matters

When we talk about financial data, like how much money people have, you often hear about both average and median. The average, or mean, is found by adding up all the numbers and then dividing by how many numbers there are. It's what most people think of when they hear "average," right?

However, the average can sometimes be misleading, especially with things like net worth. Think about it: if you have a group of ten people, and nine of them have a net worth of $50,000, but one person has a net worth of $10 million, that one person with a lot of money will pull the average way up. So, the average might make it seem like everyone in the group is much richer than they actually are, in a way.

The median, on the other hand, is the middle point, as we discussed. It's the number that separates the lowest 50% from the highest 50% of values. Because it's the middle value, it's not as affected by those really big or really small numbers. This means the median gives you a more accurate idea of what a typical person in a group has financially, which is pretty useful for getting a real sense of things.

Calculating Your Own Net Worth

Your net worth is like a snapshot of your financial standing at a specific moment. It’s a pretty simple idea, really: it’s what you own minus what you owe. This financial measure helps you keep your picture of your finances in perspective, so it's worth figuring out.

To calculate your net worth, you start by listing all your assets. Assets are things you own that have value. This could be money in your bank accounts, savings, investments like stocks or retirement accounts, the value of your home, cars, or other valuable possessions. Basically, anything that could be turned into cash, you know, counts here.

Next, you list all your liabilities. Liabilities are what you owe. This includes things like your mortgage, car loans, student loans, credit card debt, and any other money you have to pay back. Once you have both lists, you simply subtract your total liabilities from your total assets. The number you get is your net worth. It's a simple calculation, but it tells you a lot, actually. You can use a net worth calculator by age to estimate your position compared to national averages, or just do it yourself.

Median Net Worth by Age Group: Current Numbers

Net worth tends to go up throughout life for most people, usually until around the age of 75, when it often starts to go down a bit. This is because people are often working, saving, and investing during their younger and middle years, and then they might start spending down their savings in retirement. So, understanding these patterns can be pretty insightful, you know.

The Federal Reserve's Survey of Consumer Finances (SCF) gives us a good look at these numbers. The latest data, which came out in 2022, shows us some interesting trends about median net worth by age of the householder. It’s one of the most accurate snapshots of your financial health compared to others, honestly.

It’s important to remember that these are national median figures. Your personal situation will always be unique, and these numbers are just a general guide. But they do give you a sense of where things stand for many households across the country, which is useful, basically.

Younger than 35 Years Old

For householders who are 35 years old or younger, the median net worth was around $183,500 in the 2022 SCF data. This age group is often just starting their careers, paying off student loans, and perhaps saving for a first home. So, this number reflects those early financial steps, you know, which can be quite a lot to juggle.

It's a time when many are building their foundations, which means assets like retirement savings might just be starting, and debts can be relatively high from education or early purchases. The median here gives a picture of what many young households have managed to build up, or are in the process of building, so it's a starting point, really.

Ages 35 to 44 Years Old

This age group shows a significant jump in median net worth. For those aged 35 to 44, the median net worth was about $549,600. This is a pretty big increase from the younger group, and it's something many people notice, you see.

This period often sees people settling into more established careers, perhaps buying homes, and seriously building up retirement savings. There's often a huge jump from the early 30s to the late 30s and early 40s in both median and mean net worth, which suggests a time of substantial financial growth for many, honestly. It's a time when wealth accumulation really picks up speed.

Ages 45 to 54 Years Old

As people move into their mid-career years, typically between 45 and 54, their net worth often continues to grow. This age bracket usually includes people who are at or near their peak earning years, and they've had more time to save and invest. So, their financial picture often looks quite different from younger groups, you know.

This is also a time when many are focusing on things like paying down their mortgage and increasing their retirement contributions. The median net worth for this group reflects years of consistent saving and asset growth, making it a period of considerable financial strength for many households, as a matter of fact.

Ages 55 to 64 Years Old

For those approaching retirement, generally between 55 and 64, net worth typically reaches its highest point for many. People in this group have usually accumulated significant assets over their working lives and may have paid off most of their major debts, like mortgages. This makes their financial position generally quite strong, you see.

This period is often about fine-tuning retirement plans and ensuring enough savings are in place for the years ahead. The median net worth for this age group shows the culmination of decades of financial effort and planning, which is pretty impressive, really. It’s the time when many are really seeing their long-term financial efforts pay off.

Ages 65 to 74 Years Old

This age range often marks the early years of retirement for many. While some people continue to work part-time, others are fully retired and may begin drawing from their retirement savings. For this group, net worth often remains high, though it might start to stabilize or even slightly decline as assets are used for living expenses, you know.

The median net worth here reflects a period of transitioning from accumulating wealth to using it. It shows the financial resources available to support a comfortable retirement for many households. This is a big shift, basically, from building up to drawing down, and it's something people plan for over many years.

Ages 75 and Older

For householders aged 75 and older, net worth generally begins to decline. This is often because people are living off their accumulated savings and investments, and they may also face increasing healthcare costs. So, the financial picture can change quite a bit in these later years, you see.

This decline is a natural part of the financial life cycle for many, as assets are used to fund daily living and any unexpected expenses that come up. The median net worth for this group reflects the reality of spending down resources after a lifetime of work and saving, which is a pretty common pattern, honestly.

Key Factors That Influence Net Worth

Several things play a big part in how much net worth a person builds over time. It’s not just about how much you earn, though that is a piece of it. Your financial habits, for example, really shape your overall wealth, you know.

One major factor is saving consistently. Putting money aside regularly, even small amounts, can add up significantly over the years. Another big one is managing debt. High-interest debts, like credit card balances, can eat away at your money and make it harder to build assets. So, keeping debt under control is pretty important, actually.

Investment choices also play a huge role. Money that sits in a regular savings account might not grow much, but money invested in things like stocks, bonds, or real estate has the potential to increase over time. This growth, often called compounding, can make a big difference to your net worth over decades. Also, things like homeownership and education can influence your financial path, as a matter of fact, providing assets or higher earning potential.

Steps to Build Your Net Worth

If you are thinking about how to build wealth, there are some clear steps you can take. Improving your net worth is a process that takes time and consistent effort, but it is certainly achievable. It’s about making smart choices with your money, basically, over a long period.

No matter your current age or financial situation, there are always ways to work towards a stronger financial future. It might feel like a big task at first, but taking small, consistent steps can lead to significant progress. So, let’s look at some actionable ideas you can start using today, you know, to get things moving.

Remember, building wealth is not a race against others; it's about improving your own financial security and reaching your personal goals. These tips are designed to help you do just that, giving you some practical ways to grow your financial wealth effectively, which is what many people aim for, right?

Creating a Spending Plan

The first step to building net worth often involves understanding where your money goes. Creating a spending plan, sometimes called a budget, helps you see your income and expenses clearly. This way, you can figure out where you might be able to save more, you know.

Start by tracking everything you spend for a month or two. This can be a real eye-opener. Once you know your habits, you can set limits for different spending categories. The goal is to make sure you spend less than you earn, so you have money left over to save and invest. It's a fundamental part of financial health, actually.

Having a plan gives you control over your money instead of letting your money control you. It allows you to direct funds towards your goals, like paying off debt or saving for a down payment. This control is pretty powerful for improving your financial picture, you see, and it helps you make intentional choices about your money.

Paying Down Debt

High-interest debt, like credit card balances, can really slow down your progress in building net worth. The interest payments can be quite substantial, meaning a large part of your money goes just to cover the cost of borrowing, rather than building your own assets. So, tackling this kind of debt is a smart move, you know.

Focus on paying off your most expensive debts first. This is often called the "debt avalanche" method, where you pay extra on the debt with the highest interest rate while making minimum payments on others. Once that one is gone, you move to the next highest interest rate. This approach can save you a lot of money in interest over time, basically.

Reducing your liabilities directly increases your net worth. Every dollar you pay off on a loan or credit card makes your financial standing stronger. It's like freeing up money that was trapped in interest payments, allowing it to work for you instead, which is pretty good, honestly. This step is a critical part of financial freedom.

Increasing Your Income

While managing expenses is important, finding ways to increase your income can also accelerate your net worth growth. More money coming in means more money available for saving, investing, and paying down debt. This can make a significant difference to your financial trajectory, you see.

Consider asking for a raise at your current job if you have taken on more responsibilities or gained new skills. You might also explore opportunities for a side hustle or freelance work that uses your talents. Learning new skills that are in demand can also open doors to higher-paying roles, which is pretty useful, really.

Sometimes, it means looking for a new job that offers better pay or benefits. Every extra dollar you earn, especially if it’s put towards your financial goals, helps to boost your net worth more quickly. It's about finding opportunities to bring in more cash, basically, and then putting that cash to good use.

Investing for the Future

Investing is a powerful way to grow your net worth over the long term. When you invest, your money has the potential to earn returns, and those returns can then earn more returns, a process called compounding. This means your money can grow exponentially over time, you know, if you let it.

Start by contributing to retirement accounts like a 401(k) or IRA. These accounts offer tax advantages and are designed for long-term growth. Even small, consistent contributions can add up to a substantial sum over decades, thanks to the power of compounding. It’s a pretty effective way to build wealth, honestly.

As you get comfortable, you might explore other investment options like a diversified portfolio of stocks and bonds. The key is to start early and invest regularly, even if it's just a little bit at a time. Over the years, your investments can become a major component of your net worth, so it’s worth considering. To learn more about on our site, and link to this page for more financial insights.

Frequently Asked Questions About Net Worth

What is the average net worth of an American household?

The average net worth of American households was about $1.06 million in the 2022 Survey of Consumer Finances. This number is often higher than the median because a few very wealthy households can pull the average up significantly. So, it's a different way to look at the overall financial picture, you know, but it can be a bit misleading for the typical person.

How does my net worth compare to the top 20 percent?

The top 20% of households, often called the highest quintile, typically show the biggest jumps in median net worth compared to other groups. While specific numbers vary, being in this group means your net worth is significantly higher than the overall median. It shows a level of wealth accumulation that places you among the more financially established households, basically.

What is considered a good net worth for my age?

What is considered "good" really depends on your personal goals and life circumstances. However, comparing your net worth to the median for your age group, as outlined above, can give you a general idea of how you compare to others. If your net worth is at or above the median for your age, you are doing better than at least half of the households in your age bracket, which is pretty good, honestly. You can always work to improve it, of course, but it gives you a benchmark. For more detailed information, you can often find comprehensive data on financial well-being from institutions like the Federal Reserve.

Mean, Median and Mode | GeeksforGeeks

Median - GeeksforGeeks

Finding the Median: An Easy To Understand Guide