Understanding Your Money: What Average Net Worth By Age Really Means

Have you ever stopped to think about your money, wondering how your financial picture compares to others your age? It's a question many people ponder, actually. Looking at the average net worth by age can offer a kind of snapshot, giving you a general idea of where people typically stand financially at different points in their lives. This information, you know, can be pretty helpful for setting your own financial goals.

Figuring out your net worth is simpler than it sounds, basically. It's just a quick look at everything you own minus everything you owe. This number gives you a good sense of your financial health right now. It's not about being rich or poor, it's more about understanding your financial standing.

So, as a matter of fact, knowing the average figures for different age groups can provide some perspective. It helps you see what's possible and what others have achieved, more or less. This insight can really help you plan your own financial journey, no matter where you are starting from.

Table of Contents

- What Is Net Worth?

- Why Does Average Net Worth Matter?

- Factors Influencing Net Worth

- Understanding the Numbers: A Look at Average Net Worth by Age

- Beyond the Averages: Median vs. Average

- Boosting Your Net Worth at Any Age

- Common Mistakes to Avoid

What Is Net Worth?

Your net worth is a pretty straightforward calculation, you know. It represents the total value of all your assets minus all your liabilities. Assets are things you own that have value, like money in your savings account, investments, real estate, and even your car. Liabilities, on the other hand, are what you owe, such as credit card balances, student loans, mortgages, and car loans.

To figure out your personal net worth, you simply add up everything you possess. Then, you subtract all the money you owe to others. The number you get tells you your financial standing at that specific moment. It's a snapshot, really, of your financial life.

This figure can change quite a bit over time, by the way. As you earn more, save more, pay off debts, or your investments grow, your net worth will likely increase. Conversely, taking on new debt or losing value in assets can cause it to drop. It's a dynamic number, not something set in stone.

Why Does Average Net Worth Matter?

Looking at the average net worth by age gives you a general benchmark. It’s not about comparing yourself directly to others, but rather about gaining some perspective. These averages can help you see common financial patterns across different age groups, which is pretty useful.

For example, if you are just starting your career, you might see that the average net worth for younger adults is lower. This is perfectly normal, as people are often paying off student loans or saving for big purchases at that stage. Knowing this can help ease any worries you might have.

For someone approaching retirement, seeing the average net worth for older age groups can help with planning. It might show you what kind of financial position others are typically in. This sort of information can help you decide if you are on track for your own retirement goals. It's a tool for planning, not a judgment.

Factors Influencing Net Worth

Several things play a part in how someone's net worth develops over time. It's not just about how much money you make, you see. Many elements come together to shape your financial picture, and understanding them can help you manage your own money better.

Age

Age is, arguably, one of the biggest factors. Generally speaking, net worth tends to grow as people get older. Younger adults often have less savings and more debt, like student loans or a first mortgage. As people get older, they typically earn more, save more, and pay down debt, which helps their net worth climb.

This increase isn't always a straight line, of course. Life events, like having a family or unexpected expenses, can impact it. But in a general sense, time allows for more earning potential and more opportunities to build up assets. It's a slow and steady process, usually.

Income and Spending Habits

How much money you bring in and how you spend it really shape your net worth. Someone with a higher income might have more money to save and invest. However, a high income doesn't guarantee a high net worth if spending is also high. It's about the difference between what you earn and what goes out.

People who consistently save a portion of their income, no matter how much they make, tend to build wealth over time. This means being mindful of where your money goes. Small, consistent savings add up, basically, and that can make a huge difference.

Education and Career Path

The type of education you get and the career you choose can definitely influence your earning potential. Certain fields tend to pay more, which can lead to a higher capacity for saving and investing. A professional degree, for example, might lead to a higher salary down the line.

However, it's not just about the degree itself. The choices you make within your career, like seeking promotions or changing jobs for better pay, also play a part. Continuous learning and skill development can help you earn more over your working life, which, you know, helps your net worth grow.

Location

Where you live can surprisingly affect your net worth. Housing costs, for instance, vary greatly from one city to another. Living in an area with very high living expenses might make it harder to save money, even with a good income. This is a big one for many people.

Also, the job market in different regions can impact earning opportunities. Some cities offer more high-paying jobs in certain industries. So, the cost of living and the local economy both play a role in how easily someone can build their financial assets.

Debt

Debt is a significant factor because it directly reduces your net worth. Things like student loans, car loans, and credit card balances subtract from your assets. While some debt, like a mortgage, can be part of building an asset (your home), too much debt can really hold you back financially.

Managing debt wisely means paying it down strategically. High-interest debt, in particular, can be a drain on your finances, making it harder to save or invest. Reducing your liabilities is just as important as increasing your assets for a healthy net worth, actually.

Understanding the Numbers: A Look at Average Net Worth by Age

When we talk about average net worth by age, it's important to remember these are just averages, you know. They represent a general trend across a large group of people. Your personal situation might be very different, and that's perfectly okay. These numbers are more of a guide than a strict rule.

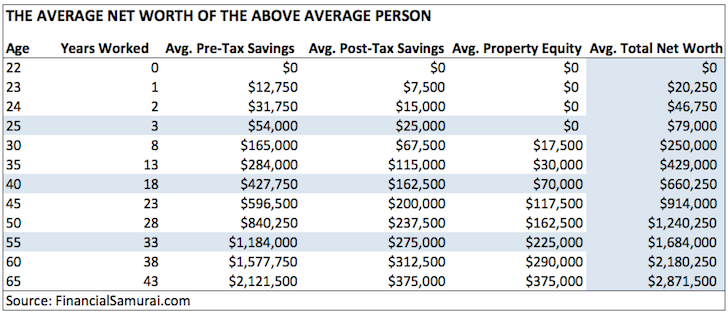

Typically, for younger adults, say those in their 20s, the average net worth might be relatively low, sometimes even negative. This is pretty common because many are just starting out, perhaps carrying student loan debt, and have not yet had much time to accumulate assets. They might be focused on building a career or saving for a first home, so their financial picture is still developing, which is natural.

As people move into their 30s and 40s, you usually see a noticeable increase in average net worth. This is often a period of higher earnings, and many people start investing more seriously, paying down some of their initial debts, and maybe even buying a home. The power of compounding, where your investments earn returns on their returns, really starts to kick in during these years, which is quite a boost.

For those in their 50s and 60s, approaching retirement, the average net worth tends to be at its highest. This is typically when people have paid off most of their significant debts, like mortgages, and have had many years for their retirement savings and investments to grow. They are often focused on preserving their wealth and planning for their post-work years, so their financial picture looks very different from someone just starting out, obviously.

It's also worth noting that these averages can vary based on many things, like where the data comes from and the economic climate at the time. A strong economy might show higher averages, while a downturn could lead to lower ones. So, while these figures offer a general idea, your own path is unique. They are just a general picture, in some respects.

Beyond the Averages: Median vs. Average

When discussing financial figures, you often hear about "average" net worth. But there's another important number: the "median" net worth. Understanding the difference between these two can give you a much clearer picture of what's really happening financially for most people, you know.

The average is calculated by adding up all the net worths and then dividing by the number of people. This number can be skewed by a few individuals with very high net worths. For example, if a few billionaires are included in a group, the average will appear much higher than what most people in that group actually possess. It's a bit like taking everyone's height and getting an average that doesn't really reflect most people if there are a few very tall individuals.

The median, on the other hand, is the middle point. If you line up everyone's net worth from lowest to highest, the median is the value right in the middle. This number is often a better representation of the typical person's financial situation because it isn't pulled up by extreme outliers. For most people, the median net worth by age is usually lower than the average net worth by age, which is pretty telling.

So, when you look at financial data, it's a good idea to consider both the average and the median. The median often gives you a more realistic idea of what most people are experiencing financially. It provides a more grounded perspective on what's typical, you see, rather than what's simply mathematically averaged.

Boosting Your Net Worth at Any Age

No matter your current age or financial standing, there are always steps you can take to improve your net worth. It's about making smart choices consistently over time. Small changes can lead to big results, actually, if you stick with them.

Start Early

If you're young, starting to save and invest early is one of the most powerful things you can do. Time is your biggest ally when it comes to building wealth. Even small amounts saved consistently can grow significantly thanks to compounding. This means your money earns money, and then that money earns more money, and so on. It's a pretty amazing effect, truly.

The sooner you begin, the less you might need to save later on. So, even if it's just a little bit each month, getting started early can make a huge difference to your long-term financial health. It's never too early to think about your financial future, you know.

Budget and Save

Creating a budget is a fundamental step for anyone looking to increase their net worth. A budget helps you understand where your money is going and where you can cut back. It's about being intentional with your spending, basically. Once you know your expenses, you can find areas to save more.

Make saving a regular habit, like paying a bill. Set up automatic transfers to a savings account or investment account. This "pay yourself first" approach ensures that you prioritize your financial future. It's a simple habit, but it's incredibly effective, obviously.

Invest Wisely

Putting your money to work through investments is a key way to grow your net worth beyond just saving. Investments can include stocks, bonds, mutual funds, or real estate. The goal is for your money to grow over time, ideally faster than inflation.

It's important to learn about different investment options and choose ones that fit your comfort level with risk. You don't need to be an expert to start; many resources can help you understand the basics. For example, you could explore different investment strategies on a site like Investopedia. Diversifying your investments, meaning spreading your money across different types, can help manage risk, which is a good idea.

Manage Debt

Reducing and managing your debt is just as important as growing your assets. High-interest debt, like credit card balances, can really eat into your financial progress. Prioritize paying off these debts first, as they cost you the most money over time.

Consider consolidating debts or creating a debt repayment plan. The less you owe, the more of your income you can put towards saving and investing, which, you know, directly boosts your net worth. It's about freeing up your money for growth, essentially.

Increase Income

Looking for ways to increase your income can also accelerate your net worth growth. This could mean asking for a raise, taking on a side hustle, or developing new skills that lead to better-paying job opportunities. More income means more money available to save and invest.

Think about what skills are in demand or what you could do to add more value in your current role. Sometimes, a small increase in income can make a significant difference over many years. It's about finding opportunities to bring in more money, so you have more to work with.

Common Mistakes to Avoid

While building net worth seems straightforward, some common pitfalls can slow your progress. Being aware of these can help you steer clear of them. It's like knowing what obstacles might pop up on your path, you know, so you can avoid them.

One mistake is not having a clear financial plan. Without goals, it's easy to drift and not make consistent progress. Another common error is neglecting to save for retirement early enough. The longer you wait, the harder it becomes to catch up, thanks to how compounding works.

Taking on too much debt, especially high-interest consumer debt, is another big one. This can quickly erode your net worth and make it tough to save. Also, not diversifying investments or making emotional investment decisions can be risky. It's better to stick to a plan rather than reacting to every market fluctuation. Staying informed and patient is key, actually.

Frequently Asked Questions

Here are some common questions people ask about net worth and financial planning, which is pretty typical.

What counts towards your net worth?

Your net worth includes all your assets, which are things you own that have value. This means cash in bank accounts, investment accounts like stocks and bonds, retirement funds, real estate, vehicles, and even valuable personal items. From this total, you subtract your liabilities, which are all your debts, like mortgages, car loans, student loans, and credit card balances. The final number is your net worth, basically.

Is it bad to have a negative net worth?

Having a negative net worth, especially when you are younger, is not necessarily a bad thing. Many young people start their adult lives with student loan debt or a mortgage, which means their liabilities might temporarily outweigh their assets. This is a common starting point for many. As long as you have a plan to increase your assets and reduce your debts over time, you are on the right track. It's about the direction you are heading, you see, rather than just the starting point.

How can I increase my net worth quickly?

Increasing your net worth quickly often involves a combination of strategies. You could try to significantly increase your income, perhaps through a higher-paying job or a successful side business. At the same time, aggressively paying down high-interest debt can make a big difference, as it stops the drain on your money. Making smart, perhaps slightly more aggressive, investments can also help, though these carry more risk. It's important to remember that truly substantial wealth building usually takes time and consistent effort, you know, rather than just quick fixes.

Conclusion

Understanding average net worth by age gives you a helpful point of reference, but it's just one piece of the puzzle. Your financial journey is uniquely yours, shaped by your choices and circumstances. The most important thing is to focus on building your own financial strength, one step at a time. It's about making progress for yourself, really.

Whether you're just starting out or nearing retirement, there are always ways to improve your financial standing. By understanding what net worth is, how it grows, and what influences it, you can make informed decisions. Remember, consistent effort in saving, investing, and managing debt will help you achieve your own financial goals. Learn more about on our site, and you can also find helpful resources on this page .

Net Worth By Age: How Do You Stack Up? - My Wealth Money

The Average Net Worth By Age For The Upper Middle Class | Financial Samurai

Average Millennial Net Worth By Age Age Average Net Worth 38 (Glass of